Federal PLUS Loan credit criteria

Credit approval

The Federal Direct Loan servicer will perform a credit check to ensure the borrower meets federally established credit criteria.

- You will be denied if you have one or more debts that are 90 or more days delinquent or that are in collection or have been charged off during the two years preceding the date of your credit report, but only if the total combined outstanding balance of those debts is greater than $2,085.

- If a parent or graduate student borrower has an adverse credit history, but qualifies for a PLUS loan due to extenuating circumstances or by obtaining an endorser, you will be required to complete special PLUS loan counseling. The PLUS counseling session will be valid until the expiration of your credit check. New credit approvals under these conditions will require a new counseling session.

Note: This special PLUS Loan counseling is separate and distinct from the PLUS Loan entrance counseling that all graduate and professional student PLUS Loan borrowers must complete.

Credit approval is valid for 180 days. Your credit is evaluated every time you request a new loan unless you have had a credit decision within the past 180 days.

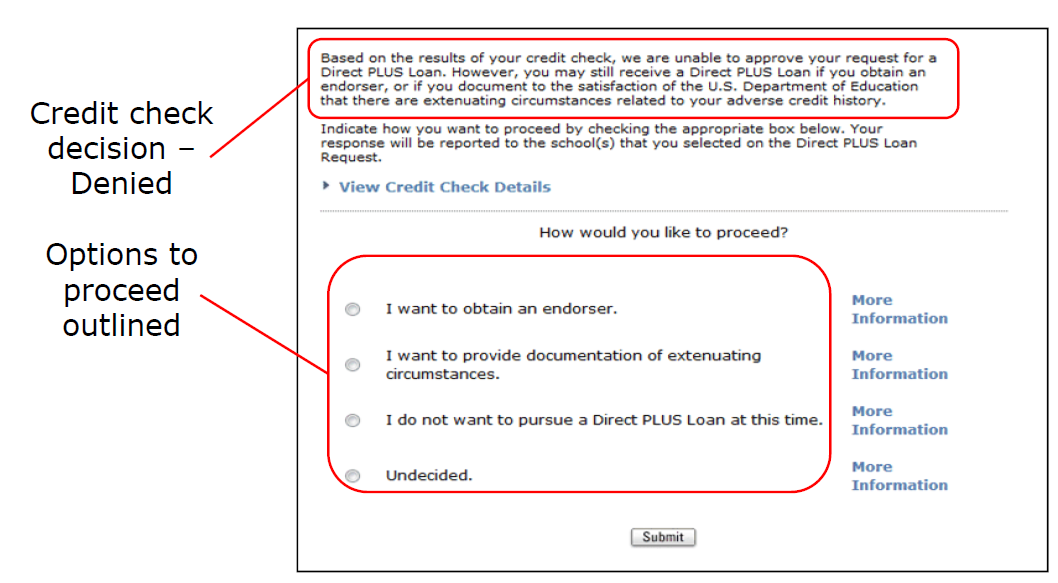

Credit denial options

Information about instructions to appeal or apply with an endorser will be given to Direct PLUS Loan applicants who receive a credit denial.

Denied applicants have the option to:

- apply with an endorser

- appeal the denial

- correct any invalid information on their credit report that may have led to the denial

You may qualify for a loan based on extenuating circumstances if the applicant:

- has been or is delinquent for 180 days or less on mortgage loan payments or medical bill payments for the applicant or the applicant’s family

- does not otherwise have an adverse credit history

You may be able to fix an adverse credit item like delinquency by making a payment and bringing the delinquency to less than 90 days.

- With a discharge or collection item, you may be able to obtain a “settled in full†status if you reach a satisfactory payment arrangement.

- If you are able to fix an item, it is no longer considered in the credit evaluation and it may result in your credit being approved.

Service contact information for PLUS Loan borrowers

- Phone: 800-557-7394

Monday-Friday: 8 a.m.-8 p.m.

- Telecommunications Device for the Deaf (TDD): 877-461-7010

Note: PLUS Loan borrowers can contact Applicant Services for credit appeal overrides and endorser application questions.

Borrowers with adverse credit histories, who qualify for a PLUS loan due to extenuating circumstances or by obtaining an endorser, will be required to complete PLUS loan counseling.

If a Parent PLUS Loan is denied

- The parent may contact the Direct Loan servicer to either appeal the decision or investigate the option of securing an endorser.

- If the parent does not appeal the credit decision or secure an endorser, the Office of Student Financial Aid will note the denial on the student record.

- If the student is eligible, we may offer a limited amount of additional Federal Direct Unsubsidized Loan funds.

- After credit denial, you have the option to not pursue a Direct PLUS Loan.